Financial Resources For Employers Impacted By COVID

While the COVID crisis continues to impact businesses large and small, 政府机构和贷款机构正在努力提供救助. 请查看以下信息,以深入了解您的业务当前可用的资源.

While the COVID crisis continues to impact businesses large and small, 政府机构和贷款机构正在努力提供救助. 请查看以下信息,以深入了解您的业务当前可用的资源.

还记得, as you consider which option is right for your situation, 要知道,这些资金只适用于因病毒造成的营运资金损失. 它们不得用于扩大业务或合并债务. 简而言之, 这种财政援助可用于支持正在进行的业务和支付维持生计所需的费用/开支. Private nonprofits are also eligible to receive SBA disaster relief.

Financial Assistance For Small Businesses

A key tool in America's economic recovery toolbox has been the Paycheck Protection Program (PPP), 它的存在是为了给雇员少于500人的企业提供财政救济, not-for-profit organizations, 退伍军人组织, 部落的担忧, self-employed individuals, 独资企业, and independent contractors. The original deadline to apply for these funds was June 30, 2020. 然而, 因为因COVID而遭受经济困难的组织表明了持续的需求, the government pushed the deadline to apply for these funds to Aug. 8, 2020. 此外,2020年5月15日,小企业管理局发布了备受期待的 PPP Loan Forgiveness Application. 最近, Consolidated Appropriations Act 于十二月通过. 2020年11月27日,以帮助仍在受COVID危机影响的无数企业. 意图d on to learn more about this legislation.

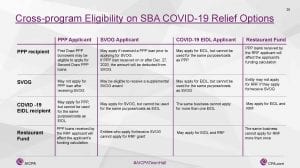

Cross-Program Eligibility On SBA COVID-19 Relief Options

美国注册会计师协会(AICPA)于2021年5月22日举行了一次城镇舞会会议. 在这个项目中,税务专业人士为注册会计师和雇主分享了许多有用的见解. The slide presented below, published with permission from the AICPA, 显示所有类型的企业主在资金仍然可用时可以申请的程序. 看看下面的内容,并联系你的当地注册会计师以获得更多的见解,或者如果你正在寻求帮助来申请帮助.

Click on the image to see the full-sized version.

Paycheck Protection Program 2.0

As a result of the ongoing financial hardships businesses are facing, legislators put forward the Consolidated Appropriations Act of 2021. 这项立法解决了PPP贷款减免费用的税收减免问题, automatic forgiveness of loans less than $150K, 二次提取贷款, extended program eligibility, 和更多的. 为了您的方便, 意图 PPP工作组提供了该计划的概述以及您应该了解的其他条款. 要阅读概述, 点击这里.

首次提取贷款

重要提示:小企业管理局(SBA)在1月8日的那一周重新开放了工资保护计划(PPP). 11, 2021, “首次提取贷款”," First Draw PPP loans can be used to help fund payroll costs, 包括福利. Funds can also be used to pay for mortgage, 感兴趣, 租金, 公用事业公司, worker protection costs related to COVID-19, 2020年因抢劫或破坏造成的未投保财产损失费用, and certain supplier costs and expenses for operations. To view more information on First Draw PPP loans, including the full forgiveness terms, 谁可以申请?, 和更多的. 点击这里 to read about PPP 首次提取贷款.

>>> Paycheck Protection Program (First Draw Loan) Application <<<

二次提取贷款

IMPORTANT: Per the Consolidated Appropriations Act of 2021, PPP现在允许以前获得PPP贷款的某些符合条件的借款人申请第二次PPP贷款,其一般贷款条款与第一次PPP贷款相同. 这些第二次提取PPP贷款可用于帮助支付工资成本,包括福利. 如果您想了解更多关于第二笔PPP贷款,请点击这里.

>>> Paycheck Protection Program (Second Draw Loan) Application <<<

Restaurant Revitalization Fund Grants

Included in the American Rescue Plan Act of 2021, 是否有一项特别拨款,专门为因COVID-19大流行而遭受经济损失的餐馆预留. 美国.S. Small Business Administration (SBA), which is in charge of administering the funds, 一直在忙着为餐厅振兴基金拨款(RRFG)的正式申请做最后的润色工作, 一旦上线, the government agency will begin taking orders, 可以这么说, 先到者, 标间. 点击这里 看看你的餐厅是否有资格从这28美元中分得一杯羹.6 Billion grant and how to apply!

Additional Resources For Small Businesses

Looking for more assistance and insight, 请点击以下链接,了解更多有关雇主可获得的财务资源.

Employee Retention Credit Eligibility Tool

Small Business Administration's Disaster Relief Loans

Paycheck Protection Program (PPP)

Paycheck Protection Program Loan Forgiveness Application

Paycheck Protection Program Flexibility Act

AICPA's PPP Loan Forgiveness Calculator

最后,由于它与关怀法案有关,我们发现了一个非常有用的 常见问题解答 文档, The Small Business Owner's Guide to the CARES Act, from the Senate Committee on Small Business and Entrepreneurship. 请看一下,因为它可能会回答您可能对《安全的赌博软件》及其对您的中小型企业的影响的许多问题.

Main Street Lending Program

“普通民众贷款计划”是美联储理事会最近在财政部的财政支持下宣布的一项新的贷款计划. Here is a high-level overview:

- 该计划适用于2020年3月13日之前成立的任何企业,并且具有:

- Up to 15,000 employees OR

- 2019 annual revenues of less than $5 billion

- You must have at least $83,333 in EBITDA in 2019 to qualify.

- 你可以借的金额是6倍你的EBITDA减去你的融资债务或信用额度(不包括PPP)在你申请贷款的日期.

- The minimum loan amount is 6x EBITDA, or $500,000.

- The maximum loan amount is $25 million

- There are no prepayment penalties.

- This program can be leveraged alongside PPP and EIDL programs.

The terms of the loan are as follows:

- 4年

- LIBOR(1个月或3个月)加上300个基点,具体取决于承保情况

- 前12个月内无应付款项(未付利息将予以资本化)

- 第二年末至少15%的本金摊销, 15 percent at the end of the third year, and a balloon payment at 70 percent at the end of the fourth year

- No forgiveness opportunities

More information from the 联邦 Reserve: 政策工具 | 新闻稿

如果你认为这个项目可能适用于你的情况,请联系你的意图顾问.

免费点播网络研讨会

巴基斯坦人民党 & 关怀法案特别工作组一直在努力为像您这样的企业提供与工资保护计划和其他现金流产生活动相关的基本信息. 看看这些由金融专家和行业专家提供的免费点播网络研讨会,以获得指导.

的意图 & 比较靠谱的赌博软件团队也在制作各种其他主题的网络研讨会. 点击这里 to check out past recordings and to register for future events.

- Understanding The Employee Retention Credit - 1月发布. 13, 2021

- What Does The New Stimulus Bill Mean For Businesses? - 1月发布. 7, 2021

- PPP Loan Forgiveness Application Process, Necessity Form & Tax Treatment - Released Dec. 8, 2020

- New CARES Act Funding To Help Small Business & Nonprofits - Released Nov. 6, 2020

- 实现后covid时代的业务目标:从不确定性到成功的过渡. 25, 2020

- Managing Business 增长 & Profitability In A COVID-19 World - Released Aug. 18, 2020

- 恢复 & Prospering In A COVID-19 World - Released June 30, 2020

- Paycheck Protection Program: The Final Chapter? - Released June 26, 2020

- 通过PPP宽恕应用程序工作- 2020年5月26日发布

- Navigating PPP Forgiveness & Certification Guidance - Released May 14, 2020

- Navigating PPP Forgiveness & Intro to Main Street Lending Program - Released April 28, 2020

- Navigating Your Bank Relationships & PPP Loan Forgiveness - Released April 15, 2020

- How To Claim SBA Disaster & CARES Act Loans - Recorded March 31, 2020

Ohio Small Business Development Centers

以下是俄亥俄州几个小企业发展中心的名单. 请 让我们知道 if you would like us to include additional counties.